Why Estate Planning Can’t Be ‘Once and Done’

Most people deem estate planning as unnecessary because the common belief is that it is something that only the wealthy require. However, the truth could not be further from it. In reality, estate planning covers many aspects that directly impact your lives and your future generations. This is why it should be taken seriously, regardless of your age or level of wealth. The responsibility of consolidating an estate is usually put off till the very end, which in many cases can lead to serious family feuds and disagreements.

Here are some important aspects that fall under estate planning:

- Last Will

- Health Care Directive

- Living Trust

- Designated Beneficiary

- Joint Ownership

The most prevalent document is the last will that specifies who inherits your wealth after your demise. It can also be used to mention who will be the legal guardian or caretaker in the case of minor heirs. This document is very important, especially if you have a considerably big estate with multiple beneficiaries.

There are two parts of a health care directive. One allows you to document your medical care, in case you are incapacitated. The other one allows you to appoint someone to make medical care decisions on your behalf.

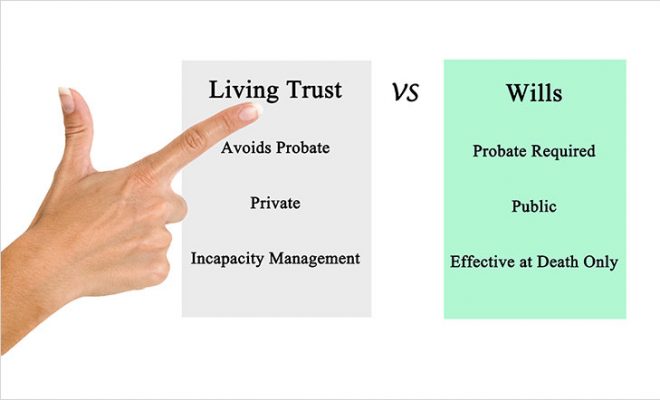

A living trust allows you to hand over the responsibility of your assets to the chosen trustee during your lifetime. The appointed trustee then manages your estate while you are still alive. It is a great tool for tax planning and can be either revocable or irrevocable.

The designated beneficiary is the nominee on your life insurance, retirement accounts, home deeds, and investment and bank accounts. It is important to note that the beneficiary has the upper hand over the individuals chosen to inherit your estate in your will, even if the will was written later. Which is why, it is recommended to always keep the names of beneficiaries updated in all your accounts.

A joint owner is someone who may co-own an asset with you. For example, you and your spouse may own a house together. If you buy a property jointly with the “rights to survivorship”, then by default, the joint owner inherits your share of the property upon your demise. It is usually advised not to add a joint owner to your estate, as it can impose gift tax implications on them.

Reasons to revisit your estate planning documents

Here are some life events and changes that bring about the need to regularly revise your estate plan:

- Inclusion or elimination from the family

- Relocation to a new state

- Addition of new assets or liabilities

- Changing tax laws

- Appointment of a new guardian for your children

- Modification of a living trust

- Death of a beneficiary

- Other changes with time

Family dynamics keep changing with time. There could be an addition to the family if you get married or have children. In the same manner you may lose some family members in the case of a family member’s death or a divorce. These changes need to be documented in your estate plan too. Your will should cover your spouse and all your biological and adopted children. If you have gone through a divorce, you may want to remove your spouse from your estate, as they may stake a claim as a beneficiary upon your death.

As per common marriage laws and domestic partnership rules, if you are seeing someone but do not wish to get married, you can have them added to your will, otherwise, your partner may end up with nothing. Similarly, unless you add your stepchildren to your will, they will have no legal claim to your estate. Finally, you may also disinherit a beneficiary if they are estranged from the family or in your view, irresponsible with money.

Since each state has its own set of laws, it is important that you discuss this change with your attorney. Most states do not have inheritance or estate taxes, which directly impacts the value of what shall be passed on to your heirs. This aspect is crucial if you decide to maintain a secondary residence in another state, because your attorney can help you decide which state should be maintained as the primary residence to get the maximum tax benefits. You may also have to update your power of attorney and health care directive in case of a medical emergency.

As time passes, you tend to grow your estate. You may sell immovable assets to increase your pool of liquid funds, invest more, or enjoy returns from past investments. Due to unforeseeable circumstances, your assets may also turn into liabilities. You must update your estate regularly so it reflects your current financial standing.

Tax laws keep changing with time. You must discuss the implications of new laws with your estate attorney and accordingly make revisions to your plan.

You may appoint guardians for your children to take care of them in your absence. If you have a fall out with the guardian or chose to appoint a new guardian for various reasons, you will need to update the same in your estate plan. It is also advisable to mention a successor guardian, in the event that the primary chosen guardian is incapacitated or no longer around.

If you had opted for a revocable living trust and now want to reconsider your decision, or move to an irrevocable trust, you will have to discuss it with your estate planning attorney and implement the changes in your plan.

Under the circumstances of the death of a beneficiary, it is important that you either assign a new beneficiary to inherit your estate or re-distribute the estate among the remaining beneficiaries.

With time your estate will see many changes. You may sell property, earn new assets, grow your retirement corpus, or inherit your parent’s or spouse’s estate. It is a good practice to take out some time every few years to revisit your estate planning documents and make the required changes.

To sum it up

Generating and maintaining assets takes a lifetime. It is advisable that you keep reviewing your estate plan from time to time, to ensure that its benefits are bestowed upon people who were a part of your life and supported you in your endeavor to grow. Estate planning revisions are also crucial as they safeguard you in the case of a health emergency, incapacitation, or disability.

If you need help with creating or revisiting your estate plan, you can reach out to Financial Advisor