How Much Does Estate Planning Cost?

Estate planning is one of the most critical steps of financial planning but it is sometimes overlooked or delayed by investors. Estate planning can be complicated and entails numerous rules, legal proceedings, stakeholder involvement, etc. It can be intimidating for some folks and make them hesitant to engage in the estate planning process.

There is a misconception that estate planning is for the rich only. Every person and every family needs an estate plan that ensures that you and your loved ones are secure from an unforeseen financial tragedy. It is a means to secure your financial future. More than half of the U.S. adults do not have an estate plan and those who do have several loopholes that may increase the chances of probate. It is advised that you consult with a professional financial advisor who can guide you on how to create and manage an estate plan to ensure optimal distribution of your assets as per your wishes and safeguard your family’s financial future.

So, what exactly is estate planning? How much does estate planning cost? What is the average cost of estate planning? Read further to know more.

What is estate planning?

Estate planning refers to a process of passing wealth, estate, inheritance from one person to another. In other words, it can be considered the process of managing and handling a person’s assets and wealth in the case of their physical or mental incapacity or death.

Estate planning is a broader area of financial management that includes division of assets, writing a will, planning taxes, improving asset value, and more, besides preparing for incapacity. It is significant because, if the planning is not right, it may lead to the inheritance ending in the wrong hands and may cause severe legal complications for the inheritors.

How does estate planning work?

Estate planning entails deciding how a person’s possessions will be managed and distributed after their demise. It also considers how an individual’s property and financial obligations will be addressed if they become incapacitated or disabled.

Writing a will is the most basic step in estate planning. The following are some other important estate planning tasks:

- Creating a durable power of attorney (POA) for the management of other assets and investments.

- Setting up trust accounts in the names of beneficiaries to limit estate taxes.

- Appointing a guardian for dependents who are still alive.

- Appointing an executor of the estate to supervise the will’s provisions.

- Adding or changing beneficiaries on life insurance, IRAs, and 401(k) plans.

- Organizing funeral services for the deceased.

- Contributing to recognized charity and non-profit organizations to lower taxable assets.

It is imperative to understand different aspects of estate planning, a few of which are listed below:

1. Creating a will

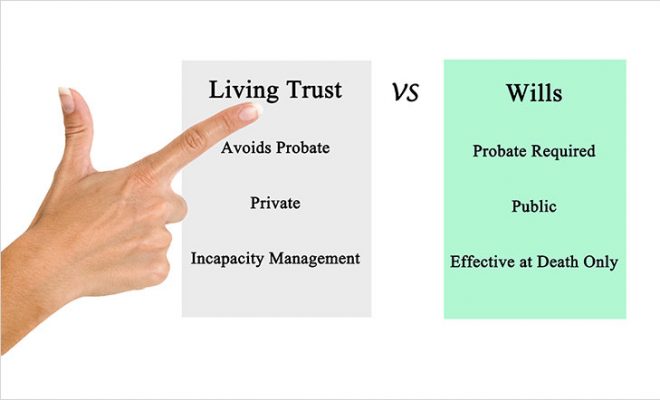

A will is a legal document that specifies how an individual’s property and, if applicable, custody of minor children should be handled after death. The document describes the individual’s preferences and specifies a trustee or executor whom they trust to carry out their stated intentions. The will also determines whether a trust should be established following the testator’s death. A trust can be established during the estate owner’s lifetime (living trust) or after their death (death trust).

2. Choosing an executor

The court-appointed legal personal representative or executor is in charge of monitoring all of the deceased’s assets. The executor is also responsible for filing the deceased’s last personal income tax filings and other related nuances. After taking an inventory of the estate, calculating the worth of assets, and paying off taxes and debts, the executor will ask the court for permission to distribute the estate’s remaining assets to the beneficiaries.

3. Making provisions for estate taxes

Before assets are disbursed to beneficiaries, federal and state taxes can significantly impair the value of an estate. Death can leave a family with significant financial obligations, necessitating generational transfer techniques to decrease, eliminate, or postpone tax payments. Individuals and married couples can take considerable steps to limit the impact of these taxes during the estate-planning process.

4. Using life insurance to pay off taxes

In many cases, life insurance can be used to pay death taxes and fees, as well as to fund corporate buy-sell agreements and retirement programs. Any income tax on deemed dispositions of assets following an individual’s death can be paid without resorting to asset sales if adequate insurance proceeds are available and the policies are appropriately arranged. The proceeds of life insurance received by the beneficiaries upon the insured’s death are generally tax-free.

What is the importance of estate planning?

Estate planning is essential for safeguarding not just your own but also your family’s interests. Without it, all of your hard-earned possessions, such as money, property, and treasures, could become tangled in a court battle. Following your death, a comprehensive estate plan helps to eliminate family disputes.

As a result, it allows you to take preventative actions to secure the financial future of your children. You will want them to have a guardian they can trust in the event you die, and you may want to minimize their financial burden as much as possible. Otherwise, fees and taxes could eat into their inheritance, leaving them with little in the end.

Cost of estate planning

The cost of estate planning varies, and the disparity in fees can add to the process. So, if you’re trying to figure out the fundamental cost of estate planning, below are a few key aspects to consider. As not all estate attorneys use the same fee structure, you may receive different quotes depending on who you speak with. It’s crucial to know who will be conducting the work, what type of plan you want, and what the legal cost of your estate planning can be. The different fee structures are as follows:

1. Hourly fee

An hourly fee is usually charged by the attorney for the time spent working on your case. This usually occurs when the attorney believes that your estate plan will require extra time or effort due to its specifications and it cannot be covered as a one-off cost. Some professionals may also prefer to charge an hourly fee based on the number of years of experience they hold and their professional knowledge and expertise.

2. Fixed or flat fee

A flat fee is a specific sum set by your attorney to cover the cost of estate planning services. The cost of preparing relevant documents, such as a will or a power of attorney, is usually included in this pricing. If your lawyer asks for a flat fee, make sure you understand what’s included. This is because it is subject to modification at the discretion of the estate planner.

3. Contingency fee

In circumstances where you get monetary compensation, you will be charged a contingency fee. For instance, when you win a court case and collect the money granted, you pay a percentage to your attorney. However, estate planners rarely use contingency fees as they’re pointless without a counter-argument.

Fees are just one aspect that can affect how much estate planning can cost. An additional fee or charges may result in higher overall pricing. Thus, you are better off requesting an estimate and a first in-person consultation, which is usually free. Comparing fees and charges is also a good idea.

Note: Estate planning is commonly not offered as a standalone service. Some financial planners may include it if they are already managing your assets. However, if your advisor were to do so, it would either be included in their asset-based fee, or they may charge you separately (in case you are not a client) in the range of $150 -$500 per hour.

How to cut estate planning costs

Estate preparation can be unpredictably tricky and expensive. Depending on your circumstances, you may be charged an astronomically expensive cost for estate planning. However, if you plan ahead of time, you’ll discover that there are ways to cut this cost. A few are listed below:

- Choose a proper lawyer: Investigate companies, read reviews, and compare them. Make an effort to meet with each of them in person.

- Recognize your requirements: Prepare yourself for your first meeting. Understand what a basic estate plan entails and whether you’ll require additional documents.

- Discuss money upfront: A firm may give a free initial consultation over the phone or in person. Use this time to talk about rates and how long the procedure will take.

- Put it in writing: Once you’ve decided on an attorney, make sure you both sign a formal agreement. It should cover the work that your lawyer will accomplish as well as any fees that may be incurred.

To summarize

Having a lot of money necessitates intricate planning for retirement, tax, and estate. When it comes to estate planning, be aware of your options and the cost of estate planning. To save money, you can do it yourself or hire an estate planning attorney. Choosing the latter choice will result in a range of costs, including flat fees, contingency fees, and hourly rates, among others. While hiring a lawyer is more expensive, you are always better off with seeking professional guidance for your estate.

Use the free advisor match tool to match with an experienced and certified financial advisor who will be able to guide you effectively on how to create an effective estate plan that will minimize estate costs and help secure the financial future of your loved ones. Give us basic details about yourself, and Paladin Registry will match you with 1-3 professional financial fiduciaries that may be suited to help you.