Estate and Succession Planning Tips During COVID-19 Pandemic

With the COVID-19 pandemic re-defining the global economic and financial scenario, it has increasingly created an environment of stress. The pandemic is also calling out for people to revisit their lives and make amends, and is a stark reminder of how one must be prepared for all uncertainties. With such an unpredictable future, it would be extremely wise for a person to consider and reconsider his or her estate and succession planning. For the ones who do not have an estate or succession plan in place yet, the COVID-19 situation is a reminder to begin it sooner than later to secure the future of their family and dependents.

Here are some easy estate and succession planning tips to be considered during the COVID-19 pandemic:

Frame your will

The first step while considering succession and estate planning is to have a will in place. While you might not like the idea of being too conservative and planning for a time when you may not be around, it is a hard truth that cannot be ignored. Moreover, given the vulnerability of human life, it is best that you accept it soon. A will is the most important aspect of estate planning and one that must be drafted with the utmost consideration. Failure to have a will in place before your demise has legal complications afterwards. Since this will make the law the sole authority to decide who inherits the estate and in what proportion.

Take advantage of joint ownership or other investment tools

In case the concept of a will is not a part of your estate plan, you can also choose to take advantage of joint asset ownerships, where the estate will automatically pass to the co-owner in case of an unfortunate event. Moreover, other financial investment tools such as insurance, trusts, etc. can be used to ensure that the estate is distributed among your heirs as intended.

Streamline foreign assets

The current situation of COVID-19 has impacted countries and economies all over the world and some more significantly than others. Hence, it is important to assess your foreign assets, if any. You can seek professional advice to reorganize such assets and ensure that they are passed on as desired. The procedure can be slightly daunting and complex but given the complexity of rules and regulations that vary per country, it must be initiated soon.

Review your assets

The COVID-19 pandemic has shrunk the biggest of economies and caused significant negative impacts on the value of multiple assets and properties. Hence, it is very important for a person to review and reconsider the worth of assets and evaluate if the allocation of the estate is still as desired. Many assets that were of immense value before the pandemic might have taken a downturn now, ultimately resulting in a low share of the estate. You should check if the current distribution and worth of assets to your nominees is as per your desires.

Keep a check on your taxes

A critical aspect that can get neglected amid the stress of the COVID-19 is tax filing. The pandemic has resulted in countries imposing travel restrictions. This has led to multiple people being stranded in a foreign land with no confirmation on their return home. While this might be emotionally excruciating, it can also cause severe financial complications for some people. For instance, the U.S. levies taxes on people who have spent a considerable number of days in the country, even if they are not a U.S. citizen. This will ultimately cause a non-U.S. citizen to fall prey to the tax implications of the country and ultimately have an adverse impact on their estate. In such cases, estate and succession planning can be revised with the help of professional advisors to lessen your tax burden ultimately. Also, for U.S. citizens stranded outside the country due to the current pandemic situation, tax implications can shoot up even in their absence. Hence, the person must keep a constant check on tax dues and if need be, appoint a professional to take care of tax matters and minimize the tax burden.

Assign a power of attorney

While the idea of assigning another person as a caretaker or master of your assets in your absence seems strange, it can be the need of the hour for some families. COVID-19 has made quarantining the new normal, so you must be prepared for any adverse circumstances. If you find yourself ill or quarantined in the pandemic, you will not have any access to your bank accounts, business, assets, etc. As a result, your estate value can suffer, and some important decisions may be put on hold, causing an even severe dent on your estate’s worth. Thus, it would be advisable to consider appointing a power of attorney to take charge of things in the estate in your absence. However, you can always restrict the nature of authority to ensure that you retain the major decision-making powers. You can also choose a restrictive clause which would imply that the current arrangement will be active only until a specified situation. You must keep in mind that the ultimate choice of a power of attorney should be made with extreme prudence and consideration.

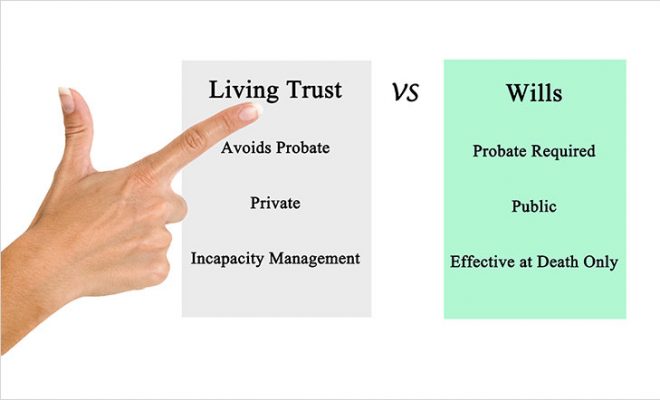

Incorporate a private trust

A private trust is a great method to secure the estate and carry out hassle-free succession in the future. Private trusts are flexible and allow easy management and precise distribution of assets as per the desire of the estate owner. Establishing a private trust not only helps you to make an effective estate and succession plan for your nominees but also enables you to retain significant control. The main advantage of building a private trust in these times is that they are flexible and can be tailored as per the individual needs of the family. Moreover, these can be dissolved, revoked or modified as per the desire of the creator. This allows you sole discretionary powers to change the estate plan once the COVID-19 situation eases. However, the selection of trustees and the trust assets must be made with caution to minimize unnecessary complications and financial burdens.

To sum it up

The long-stream financial implications of the current COVID-19 situation are highly taxing. The global pandemic has adversely impacted economies and the financial stability of even the most developed countries, including the U.S. In such critical times, with no visible end of the economic turmoil caused by the novel coronavirus, it is vital and also highly practical for people to consider creating or re-visiting their estate and succession plans.

Moreover, given the wide-ranging, severe impact of the pandemic on financial markets, the future seems more complicated and uncertain by the day. Professional guidance from Financial Advisor can help you ensure that your fundamental plans are reliable and accurately in place.