8 Tips for Avoiding Mistakes While Writing Your Will

A will guarantees that your wishes are executed after your death, or for ensuring that you are taken care of in case of an illness, disability, or any other condition, causing loss of financial control. Yet it is staggering that 68% of Americans do not have a will, as per the journal, The Conversation.

That said, even if you have a will in place, your beneficiaries may face problems in your absence because the laws surrounding a will are intricate. The chances of committing a mistake are high while drafting a will, leading to disputes, and in some cases, rendering the document invalid.

So, to avoid this potential ordeal, you should follow these eight tips to create a will:

- Plan for life and death

Your will is a guiding document for the distribution of your assets in your absence. But it is also a directive that governs the present, in case of your incapacity. So, be careful to draft a will, which is truly comprehensive. Ensure that it addresses what happens in case of your death, as well as specifies what happens if you are incapacitated. To be sure that your will is fool-proof in this regard, you could draft complementary documents. These papers are known as advanced directives and contain legally binding directions for caregivers in case you are unable to articulate your wishes. It is also advisable to appoint a power of attorney for your health and financial issues. These individuals will hold the authority to make decisions on your behalf, in their respective spheres in the event of your incapacitation.

-

Identify beneficiaries

Your will is the only legal method to ensure that your assets go to your beneficiaries after death. So, your will should specify your beneficiaries and their share in your property. For this purpose, the first step is to take note of your assets. This includes shared holdings, bank balances, savings, investment accounts, policies, etc. Also, account for possessions like a house, car, jewelry, etc. List your liabilities too and gather necessary documents, certifications, registrations, and licenses. This will help you determine the value of your inheritance and decide the distribution. Mention what is to be distributed, to whom, and in what share. State the full name of all receivers, along with their address and date of birth. Leave unambiguous instructions for the distribution of your estate. However, be careful when assigning beneficiaries in the will, since all shared accounts like an IRA (Individual Retirement Account), a company 401(k) account, and life insurance policies will have an existing nominee. Ensure that both recipients are the same. In case there is a difference, make the changes well in time. If there is a disagreement between the nominees of the will and the shared accounts, the latter will be given preference over the will.

-

Provide for Taxes

When writing a will, do not forget the role of the IRS (Internal Revenue Service) in your estate. Generally, the IRS levies taxes on the estate and property distribution above specific limits. For 2020, the federal estate tax is applicable if the assets exceed $11.58 million at the time of death. The rate for estate tax can be up to 40%. This reduces the worth of your assets, as well as creates a liability. Thus, you cannot forgo this obligation in your will. So, mention who is responsible for paying off the estate taxes and its impact on the distribution of assets. You could also separately keep a sum aside in the will, and direct your executor to pay off the estate taxes on behalf of your heirs.

-

Choose your executor and trustees

Do not underestimate the value of an executor in your will. Create a will and appoint a reliable executor for your estate. This executor, also known as the estate administrator, will be responsible for reading your will and ensuring its precise administration in case of your death or incapacitation. That said, be careful when you choose an executor. Avoid appointing a surviving spouse or a child as an executor. Instead, pick someone who is not a stakeholder in your property. The person should be of sound-mind, responsible, and trust-worthy. Some common choices include your bank, family member, friend, or your attorney. The person you select as your estate administrator will supervise the distribution of assets and the payment of liabilities, taxes, etc. Make sure that the appointed executor is ethical and not easily intimidated by legal issues or hassles. Additionally, if you plan to create a trust for your estate, assign accountable and honest trustees.

-

Appoint a guardian, if necessary

If you have a minor or a disabled child, or a kid that needs special attention because of health issues, you must name a guardian in your will. This person will be responsible for taking care of your children in the manner that you specify. You could assign a salary for the custodian, a share in your property, or some financial rights. It is advisable to choose a care taker who is close to you and can be trusted. The person you select should also be willing to assume the responsibility in your absence.

-

Draft a clear and comprehensive will

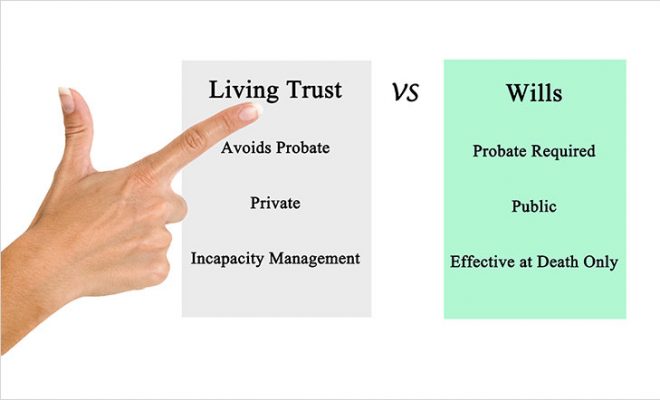

In a will, you must be clear in your approach and writing. You should include a specific division of all your property. In case you want to assign someone the duty to pay off debt obligations, mention it in your document. Also, precisely allocate the beneficiary share with their full names and details. Include details of designated guardians, executors, and trustees. Remember to create your will in the best of your health and with a sound state of mind. Avoid negligence or vagueness because it will make the will subject to probate.

-

Sign your will and get two witnesses

A will is considered a valid document only when it is signed in the presence of at least two witnesses. Hence, once you create your will, sign and date the document in the presence of at least two witnesses. However, they cannot be the beneficiaries of your estate. Also, they do not have to know the inclusions of the will. But these two people will sign and agree to be witnesses by affixing their names and addresses in the will. Additionally, sign on all the pages of your will, and mark your name and date clearly on the last page.

-

Safeguard and review your will periodically

Sign and verify your will, and secure it in a place away from possible damage like fire, theft, etc. Also it is advisable to inform your lawyer, bank, or a dependable family member or friend about where to find the will. Update the will in a timely manner to ensure it is still in line with your desires. It is good to review your enlistments, assets, liabilities, etc. and make any changes if required. Ideally, reconsider the distribution dynamics of your property periodically because of appreciation and depreciation in the asset value. The objective is to be certain that your beneficiaries get the sum you desire. Further, with significant life events, like marriage, children, divorce, disability, etc., you may like to update your will to avoid any hassles in the court.

To sum it up

Matters contained in the will can be complicated and may lead you to make mistakes. To avoid a probate, feud, or other legal hassles, you can follow these tips. Moreover, you can engage with a professional financial advisor to create a will that ensures the security of your loved ones.