Will vs. Trust: What’s the Difference?

When it comes to safeguarding the future of the next generation, people generally consider various investments, savings options, and assets, both tangible and intangible. However, the savings you secure for the next generation can fall in the wrong hands, if not passed on in the right manner.

Having a will or a trust (living trust) can go a long way in ensuring that your assets or estates are passed on to your chosen ones without any issues. A will or a trust can save you and your assets from the delays of a court-supervised guardianship, while allowing your successors to bypass the costs and hassles of a probate.

When it comes to choosing between a will and a trust, people often get confused as both are seen as an effective estate planning tool. But one must keep in mind that a wrong choice, when it comes to choosing between the two, can have a significant impact on the lives of your near and dear ones.

Here is all you need to know about a will and a trust.

What is a will?

A will is essentially a signed and witnessed legal document that establishes whom a person’s estate is distributed amongst, in the event of their death.Salient features of a will:

- A will needs an executor who carries out the terms of the will.

- A will needs a list of beneficiaries, amongst whom the estate would be distributed.

- It must contain directions on how and when the heirs would acquire the assets.

- There should be clear instructions on how and when debts and taxes should be repaid or paid.

- There must be a guardian in case the beneficiary is a minor. The guardian is entrusted with the responsibility of looking after the children, just like the parents. The guardian also ensures that the estate is duly handed over to the beneficiary on reaching adulthood.

Wills are generally not very expensive, and an enforcer can amend or revoke the document anytime during their lifetime. However, a will has certain limitations – one cannot put any condition on the gifts, and it doesn’t come into effect while the enforcer is alive or incapacitated.

What is a trust?

A trust is a fiduciary or legal arrangement, wherein the trust owner authorizes another person or a third party, known as the trustee, to take possession of the assets on behalf of the beneficiary. A trust is a powerful tool of property management wherein the trust owner can choose precisely when and how the assets get passed on to the beneficiary.

Salient features of a trust:

-

- A trust helps save time, cost, and taxes. As trusts may be allowed to pass outside the probate, it can help the beneficiary save a lot on the court fees and estate taxes. Thanks to the reduced court formalities, it also saves a lot of time.

- Trusts can ensure asset protection. As the trust owner can precisely specify the terms of the distribution of the assets and the time, it can help the trust owner safeguard their property from the heir’s creditors, or from an unworthy heir who may not be proficient at managing money.

- Trusts also help maintain your privacy. Trusts may not be required to undergo the process of a probate, and trust disbursements generally remain private.

Like a will, trusts can also be amended depending on their type. But the major limitation with a trust is that it is generally very expensive, as the cost of setting up and maintaining a trust is considerably high. Moreover, the terms of a trust are quite complex, and one needs proper legal help to understand them.

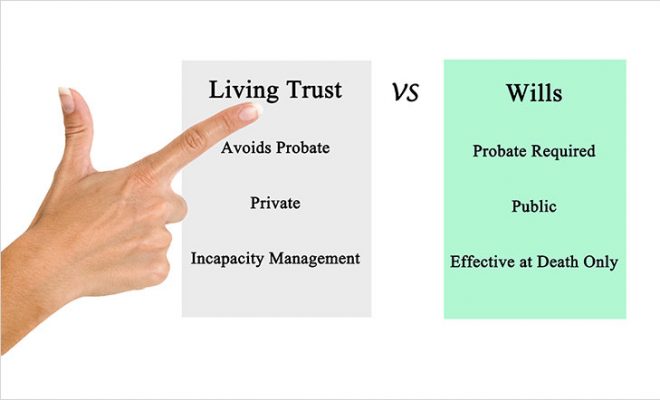

Here are some major differentiating points of what a will or trust can do.

-

-

- A will is a signed and witnessed legal declaration of the testator directing how and when their assets will be distributed amongst the legal heirs, after a person’s demise. On the contrary, a trust is a legal arrangement wherein the settlor authorizes the trustee to hold the assets on behalf of the beneficiary.

- A will comes into effect only with the demise of the testator, while a trust comes into effect as soon as the documents are signed, and the assets are transferred to the trustee. Trusts are flexible instruments and can come into effect before death, at death, or even afterwards.

- A will doesn’t take into consideration mental or physical disability, whereas provisions for disability can be considered in the terms of a trust.

- Only the assets owned by the testator can be distributed under a will. However, in case of a trust, only the specified assets can be transferred to a trust and then subsequently distributed as per the terms.

- In case of a will, with the demise of the testator, the beneficiary receives all assets at one go. This can have its own impact on the beneficiary. In case of a trust, the gifts can be tagged with certain conditions. Therefore, a well-structured trust not only ensures better management of the inherited assets but also safeguards the beneficiary from squandering all the received benefits.

- A will has to undergo the probate process, wherein the court authenticates the validity of the will and takes care of the administration and disbursement as per the testator’s wish. In case of a trust, it has very little regulatory oversight as it is deemed to be a trust and the trustee’s responsibility.

- Privacy is one of the key differentiators between a will and a trust. All probated wills are public documents, and therefore accessible by the public in general. A trust, on the other hand, is not a public document as it doesn’t have to undergo the probate process, and therefore it preserves privacy within the family.

- In the case of a will, the court and the attorney fees are to be borne by the beneficiary. Whereas, in the case of a trust, the trust owner must provide the trustee fee and other regulatory fees.

-

To sum it up

Both, a trust and a will, are effective estate planning tools, but both have their own advantages and disadvantages. The two can go a long way in ensuring a hassle-free transfer and distribution of assets, but picking the one that is the best for you, can entirely depend on your needs, assets, family composition, and budget.

Opting for professional help while dealing with such crucial matters can ease out some of your confusion. Get in touch with Financial Advisor to know more about estate planning.