Basic Primer on Revocable and Irrevocable Living Trusts

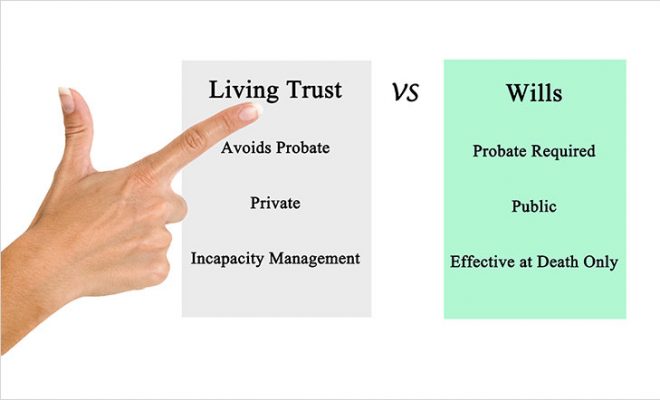

Many individuals are aware of the role a will plays in the distribution of their assets after death. Without a doubt, a will is an integral part of estate planning. However, a comprehensive estate plan also considers other aspects apart from death. These include conditions like mental incapacity, disability, long-term care, critical illness, etc. In this regard, a will may not be a comprehensive solution. Hence, it is critical to consider creating a trust to safeguard your future when you are healthy and with a sound mind. This also secures the distribution of your estate as per your wishes in your absence. But trusts come with different features and sizes. The most popular trusts, i.e., living trusts, are either revocable or irrevocable. Both these living trusts are different and have unique advantages.

Here is a basic primer on revocable and irrevocable living trusts:

What is a revocable living trust?

A trust is a separate living entity that you set up to manage your assets and properties. In a revocable living trust (RLT), you create a trust document that can be changed over time. This document is a written agreement or declaration in which you appoint a trustee to administer your property in your absence or incapacitation. You have the right to name any competent person as your trustee. However, it is advisable to choose someone who is not a stakeholder in your estate as your trustee. For this purpose, you can consider appointing your bank, attorney, or a trust company, as trustees of your RLT.

As a grantor, you can also choose to act as the trustee of the RLT for your lifetime. If the objective of the trust is to ensure continuity, you can name a ‘successor trustee’ who will receive the benefits in case of your death. Alternatively, you can also assign the power of attorney of your RLT to plan for the possibility that you could be unable to manage your affairs later in life. In other cases, you can also appoint a co-trustee to take over the reins without any disruption in case your health declines or you are disabled or mentally incapacitated.

How does a revocable living trust work?

Once you set up a revocable living trust, you place all your estate assets into the trust. This includes your real-estate properties, bank balances, home, investments, etc. After you put everything into the trust, you no longer own the assets, instead you become the grantor of the assets. The transferred assets then belong to the trust.

However, since this is a revocable living trust, you retain control over the assets, their usage, and distribution while you are alive. You can make any changes or amend the terms of the trust, asset distribution, beneficiaries, etc., any time you wish. The income earned by the assets of the trust is your money and is taxable in your hands. That said, the assets only transfer to your official beneficiaries after you die or explicitly mention a condition for it to happen. This can include your disability, loss of sound mind, etc.

What are the benefits of a revocable living trust?

- Flexibility: The main advantage of a revocable living trust is that it allows you the freedom to make any alterations to the trust. You can change, add or remove, beneficiaries of your estate. Or you can alter any stipulations governing how assets within your trust are managed and distributed. You can even dissolve the trust when you are alive if you deem fit.

- Avoidance of probate: When you create a living trust, you avoid probate on your estate. Probate is a legal process that governs the transfer of your assets when you die. Establishing an RLT helps you avoid probate, ensuring a faster and hassle-free transfer of property to your beneficiaries. Besides, this allows your estate to be distributed and managed as per your desires.

- Privacy: A will can be subject to probate, which can place all documents entered into it in the public domain, available to anyone. In the case of RLTs, your estate records remain private even after your death.

- Eliminate any challenge to the estate: In a standard will, disputes may arise regarding asset distribution. Moreover, a will can be challenged for alteration by any of the family members. However, with an RLT, you can disinherit any person who can potentially challenge your wishes upon your death.

- Continuous estate management: When you hire a professional trustee to manage your trust, you allow your accumulated corpus to grow for generations to come. You can limit withdrawals, ensure specific return on investment, list emergency withdrawal limit, etc.

What is an irrevocable living trust?

In contrast to an RLT, an irrevocable living trust is a type of living trust that cannot be modified or terminated. However, in some cases, the beneficiary or beneficiaries appointed by the grantor can modify or amend the irrevocable living trust.

These trusts are formed by an attorney and can be quite complex, owing to their irrevocable nature.

How does an irrevocable living trust work?

Typically, an irrevocable living trust has three parties – the grantor, a trustee, and a beneficiary. After setting up this trust, the grantor (you) places all your assets into it. These assets can include but are not limited to property, life insurance policies, cash, investments, business, etc. You specify the rules, terms, and uses of the irrevocable trust, assign the distribution percentages, and enlist beneficiaries.

These assets are treated as a gift to the trust, and once finalized, you cannot revoke them. On the other hand, once the assets are removed from your incidents of ownership, they are also effectively removed from your taxable estate. Hence, this relieves you of the tax liability on the income these assets generate. But if you are the trustee of the said trust, you will not be eligible for any tax benefit on your estate.

What are the benefits of an irrevocable living trust?

- Tax advantages and other benefits: By transferring the assets to an irrevocable living trust, you can reduce your taxable estate liability since these assets will then belong to the trust. You can also choose to direct the appreciable assets into the trust to minimize estate taxes. Moreover, the trust can be used to deplete your property to become eligible for government benefits like Social Security, Medicaid, etc.

- Avoid probate for vulnerable professions: For individuals engaged in vulnerable professions, like doctors or attorneys, an irrevocable living trust can be a great option. Once the assets are transferred to this trust for the benefit of the named beneficiary, it will be safe from any legal hassles, creditors, or lawsuits.

- Slightly flexible: As compared to RLTs, irrevocable living trusts are more rigid. Yet with new provisions like decanting, the latter has become more flexible than before. Decanting allows a trust to be shifted into a newer trust with more progressive features. You can also change the state of domicile of the trust for better tax advantages.

- Governed usage of funds: You can specify terms and conditions of usage and distribution of assets when you are alive, which cannot be modified later. This will help you ensure that the assets are not misused and last for a longer time.

To sum it up

Each of the two living trusts has its pros and cons. The choice between both these trusts depends on factors such as your estate value, legal estate complications, tax implications, and ultimate financial objective. However, forming a trust can be intimidating and complex. Hence, it is best to consult a professional financial advisor to create a trust that best suits your requirement.