Common Aspects of Failed Estate Plans that You Must Avoid

Estate planning may seem like a simple task, but it is not necessarily so. In the past, there have been numerous instances where people have accidentally cut loved ones out of their inheritances or have completely lost their estates due to faulty planning and management. Besides, poor estate planning has also led to unnecessarily heavy tax bills and long-drawn legal battles for some families.

While you do not have to spend too much of your time or money on your estate planning efforts, it is necessary to cover all your bases to avoid making mistakes that can lead to dire consequences in the future.

Here’s a closer look at some of the common pitfalls of failed estate plans that you need to avoid at all costs:

- Doing it all yourselfArguably, the worst mistake you can make is thinking that you can plan and manage your estate all by yourself. Estate planning is not just about drafting documents. Rather, it involves an intricate understanding of finances, and also of the tools can help you reach your goals in life. Not everyone can plan their estate efficiently by using automated software or relying on information from the internet.

The simplest of tasks can often cause the most problematic of estate planning mistakes. Therefore, you should always employ a competent estate-planning attorney to ensure that your estate plan is properly drafted and any changes in the future are made in a correct and optimum manner. While you might be able to do it all by yourself, long-term outcomes will be better if you have some professional help along the way.

- Underestimating the size of your estateSince estate planning is a slow and steady process that involves working hard for several years, it is often easy to overlook the size of your estate. Many people make the common mistake of thinking that their estates are too small and do not warrant any kind of estate plan at all. However, this can be incorrect and unwarranted thinking on their parts.

Estate planning is not about how much you have – it is about handling what you have. While the size of your estate and your net worth should dictate the type of estate plan that is suitable for you, do not forget that even small estates warrant some degree of planning.

- Failing to name or update beneficiary designationsDespite planning and making special provisions for beneficiaries in the future, some individuals forget to update their beneficiary designations with the passage of time.

Many people select their beneficiaries while opening an account or buying a policy and never review their decision even after marriage, divorce, death, or other such life events.

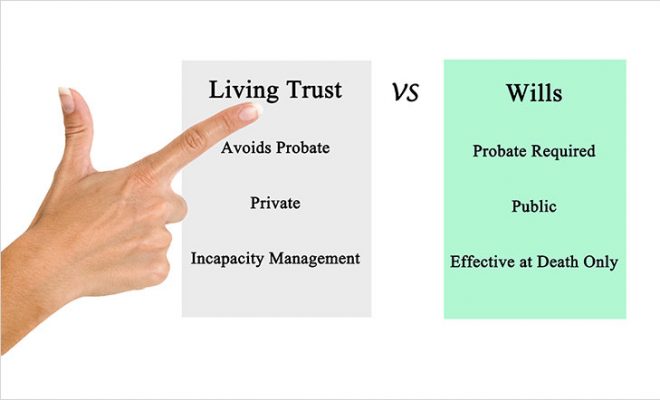

Failing to name a beneficiary means that your assets must go through the probate process, whereas a faulty or inconsistent beneficiary designation can defeat your intended distribution scheme. So, ensure that your beneficiary designations are up-to-date.

- Not planning for the unexpectedAt times, life can throw unexpected curveballs, and your estate plan can fail for lack of adequate planning beforehand. You should be prepared for unexpected but possible life events like a sudden decline in your spouse’s health or your children going through a divorce.

Your estate plan should include a financial power of attorney that names someone you trust to act on your behalf if you are rendered incapable of managing your financial affairs. Besides, you should also have a healthcare power of attorney granting someone the authority to make medical decisions on your behalf in case you are incapacitated to do the same.

- Adding the wrong people to your bank accountsSome people errantly add incorrect people to their bank accounts only to suffer unintended consequences in the future. Each time you add someone’s name to your account, you are inadvertently giving that individual the effective ownership of your account. Furthermore, you are subjecting your account to the respective individual’s creditors too.

The law presumes that a joint owner has an ownership interest in one-half of the asset. In addition to this, the bank account is liable to be passed on to your joint-owner upon your death too. So, think long and hard before you add someone to any of your bank accounts.

- Not accounting for taxesWhen drafting estate planning documents, taxes should be one of your most important considerations. If you fail to account for this crucial aspect, it could come to haunt you in the future, as it does with many people. Since federal taxes can be very high and eat up a significant portion of your assets, your heirs and beneficiaries may not get as much as you originally intended.

To avoid such a scenario, it is advisable to plan ahead and account for taxes now as well as in the future. The main types of taxes you should keep a watchful eye on include income tax, estate taxes, and probate expenses.

- Not reviewing your plan regularlyEstate planning is not a one-time process where you can just draw up the required documents once, lock them in a safe, and then promptly forget about them. However, many people make the mistake of not updating their estate plan documents as time goes by and changes occur. It is essential to review your estate plan every so often due to always-changing tax laws and certain life events that alter the scope and nature of your finances.

You should review and update your estate plan whenever there’s a major change in your family life, such as birth, death, marriage or divorce, to name a few. Many other factors like a change in your net worth or employment status should also call for a review. As a thumb rule, many financial experts and advisors suggest reviewing your estate plan at least once every 3-5 years.

To sum it up

Many estate plans do not meet their original intent owing to the common mistakes mentioned above. Changes in family and financial circumstances, tax laws, etc. can erode a plan’s effectiveness and render it outdated and useless.

Ultimately, your plan should evolve as your circumstances do. It helps to find yourself a competent financial advisor and watch your step while navigating the often-complicated world of estate planning.

If you require any estate planning advice or assistance, get in touch with the best Financial Advisor in your state.