matched to your specific needs

No obligation to hire

Personalized advice for Portfolio

Size of 100K and above

FINRA/SEC Registered Advisors

Find Retirement Advisors for Retirement Planning in Chevy Chase, Maryland

With so many financial products and solutions available in the market, it is a daunting task to choose the best one for you. We have over 20 years of experience in finding the best financial planner as per your requirements in the field of retirement planning. Our vetted certified retirement financial planners can help you plan for your dream retirement.

All our retirement planners go through rigorous industry experience, disclosures, and registration checks. Our qualified retirement planners are specialized in investment management, insurance advisory, 401k rollovers, and estate planning. Their work experience ranges from being part of small independent firms to Fortune 500 companies.

Finding the Best Retirement Planners in Chevy Chase, Maryland

Last Updated - March 4, 2026Chevy Chase has 26 Retirementplanning.net vetted Retirement Planners and Advisors on the online list below for you to choose from and 15 non-vetted advisors in your local area. These retirement advisors in Chevy Chase, Maryland have an average of 19 years of experience.

HELP ME FIND MY PLANNER

List of Qualified Retirement Planning Advisors in Chevy Chase, Maryland

VERIFIED

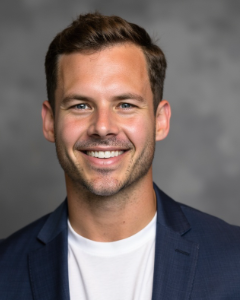

VERIFIEDDavid Middleton

CFP®, AIF®

Middleton Advisory

Qualifications

CRD# 5398638

Firm CRD# 155334

Series 65

Minimum Assets Required

$500,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management

Compensation/Fee

Fee-Only

VERIFIED

VERIFIEDQualifications

Firm CRD# 104510

Minimum Assets Required

Not Specified

Address

- 6550 Rock Spring Drive,

Suite 510,

Bethesda, MD 20817 See Details - 12510 Prosperity Drive,

Suite 350,

Silver Spring, MD 20904 See Details - 1750 Tysons Boulevard,

Suite 1140,

Tysons Corner, VA 22102 See Details - 1800 Diagonal Road,

Suite 480,

Alexandria, VA 22314 See Details - 4000 Legato Road,

8th Floor,

Fairfax, VA 22033 See Details - 19775 Belmont Executive Plaza,

Suite 530,

Ashburn, VA 20147 See Details - 6031 University Boulevard,

Suite 150,

Ellicott City, MD 21043 See Details - 900 Bestgate Road,

Suite 407,

Annapolis, MD 21401 See Details - 901 Dulaney Valley Road,

Suite 901,

Towson, MD 21204 See Details

Advisory Services:

Not Specified

Compensation/Fee

Fee-Only, Based on Assets

VERIFIED

VERIFIEDErich Imphong

CFP®

Plotkin Financial Advisors, LLC

Qualifications

CRD# 5083311

Firm CRD# 7717

Series 7, 66

Minimum Assets Required

$250,000

Advisory Services:

Portfolio Management, Retirement Planning, Money Management, Financial Planning for Individuals, Tax Advice and Services, Estate Planning & Trusts

Compensation/Fee

Fee-Based, Commissions, Based on Assets

VERIFIED

VERIFIEDQualifications

CRD# 7406005

Firm CRD# 7717

Series 7, 66

Minimum Assets Required

$0

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Tax Advice and Services, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Based on Assets

VERIFIED

VERIFIEDDrew Leisure

BSG Advisers

Qualifications

CRD# 6295263

Firm CRD# 297243

Series 63, 66

Minimum Assets Required

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Flat Fee, Based on Assets

VERIFIED

VERIFIEDMichael T. Jobe

Glover Park Wealth Management, LLC

Qualifications

CRD# 5179276

Firm CRD# 309793

Series 66

Minimum Assets Required

$25,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Based on Assets

VERIFIED

VERIFIEDBob Howard

Prudential

Qualifications

CRD# 2621872

Firm CRD# 8733

Series 6, 7, 24, 63, 66

Minimum Assets Required

Not Specified

Advisory Services:

Not Specified

Compensation/Fee

Not Specified

VERIFIED

VERIFIEDSkip Thompson

Prudential

Qualifications

CRD# 6519243

Firm CRD# 8733

Series 6, 7, 24, 63, 66

Minimum Assets Required

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Commissions, Flat Fee

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Legal Advice and Services, Estate Planning & Trusts

Compensation/Fee

Fee-Only, Based on Assets

VERIFIED

VERIFIEDMY Wealth Management, Inc.

CFP®, ChFC®

Qualifications

CRD# 2818198

Firm CRD# 168566

Series 65

Minimum Assets Required

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Flat Fee, Based on Assets

VERIFIED

VERIFIEDDoug Miller J.D.

CFP®, CLU®

Northwestern Mutual

Qualifications

CRD# 4130719

Firm CRD# 2881

Series 6, 7, 63, 65, 66

Minimum Assets Required

$50,000,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Tax Advice and Services, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Commissions, Flat Fee, Based on Assets

VERIFIED

VERIFIEDTom Hagigh

EPE Wealth Advisors

Qualifications

CRD# 2583423

Firm CRD# 6413

Series 7, 63, 65

Minimum Assets Required

$500,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Commissions, Based on Assets

VERIFIED

VERIFIEDQualifications

Firm CRD# 169517

Minimum Assets Required

Not Specified

Advisory Services:

Not Specified

Compensation/Fee

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Investment Advice & Management, Tax Advice and Services, Estate Planning & Trusts

Compensation/Fee

Fee-Only, Flat Fee

VERIFIED

VERIFIEDGeoffrey Burroughs

CFP®, Financial Planning Specialist, CDFA®

Harbor Investment Advisory

Qualifications

CRD# 5379858

Firm CRD# 151085

Series 7, 31, 66

Minimum Assets Required

$250,000

Advisory Services:

Not Specified

Compensation/Fee

Fee-Based, Based on Assets

VERIFIED

VERIFIEDChris Schiesser

CFP®

Prudential Advisors

Qualifications

CRD# 5023056

Firm CRD# 8733

Series 6, 7, 63, 65

Minimum Assets Required

Not Specified

Advisory Services:

Not Specified

Compensation/Fee

Not Specified

VERIFIED

VERIFIEDNathan Badowski

CFP®

Prudential

Qualifications

CRD# 4198119

Firm CRD# 8733

Series 7, 63, 65, 66

Minimum Assets Required

Not Specified

Advisory Services:

Not Specified

Compensation/Fee

Fee-Based

Top 15 Retirement Planning firms in Chevy Chase, Maryland (Ranked by AUM)

| Rank | Firm Name | Assets Under Management | Total Clients | Total Advisors | Fee Structure |

|---|---|---|---|---|---|

| 1 | 5404 Wisconsin Avenue, Suite 1000 Chevy Chase, MD, 20815 | $8,453,857,329 | 26 | 61 | A percentage of AUM, Performance Based |

| 2 | 4445 Willard Ave, Suite 900 Chevy Chase, MD, 20815 | $4,084,712,810 | 14 | 86 | A percentage of AUM, Performance Based |

| 3 | 2 Wisconsin Circle, Suite 940 Chevy Chase, MD, 20815 | $3,951,461,460 | 46 | 17 | A percentage of AUM, Performance Based |

| 4 | 4445 Willard Avenue, Suite 1100 Chevy Chase, MD, 20815-3695 | $2,589,069,260 | 131 | 23 | A percentage of AUM, Other (ORIGINATION FEES ON PRINCIPAL LOAN TRANSACTIONS) |

| 5 | 4445 Willard Avenue, Suite 950 Chevy Chase, MD, 20815 | $1,611,239,387 | 17 | 15 | A percentage of AUM, Performance Based |

| 6 | 4445 Willard Ave., Ste. 600 Chevy Chase, MD, 20815 | $1,328,788,451 | 1654 | 6 | A percentage of AUM, Fixed fees |

| 7 | 2 Wisconsin Circle, Suite 600, Chevy Chase, MD, 20815-7020 | $665,854,051 | 476 | 4 | A percentage of AUM, Hourly charges |

| 8 | 5610 Wisconsin Ave #108, Chevy Chase, MD, 20815 | $496,493,260 | 114 | 1 | A percentage of AUM |

| 9 | 2 Wisconsin Circle, Suite 1150 Chevy Chase, MD, 20815-7003 | $358,861,756 | 3 | 11 | A percentage of AUM, Performance Based |

| 10 | 4445 Willard Avenue, Suite 600 Chevy Chase, MD, 20815 | $287,009,717 | 3 | 10 | A percentage of AUM, Performance Based |

| 11 | 2 Wisconsin Circle, Suite 910 Chevy Chase, MD, 20815-7040 | $188,309,554 | 314 | 5 | A percentage of AUM, Hourly charges, Fixed fees |

| 12 | 2 Wisconsin Circle, Suite 700 Chevy Chase, MD, 20815 | $186,500,000 | 366 | 4 | A percentage of AUM, Hourly charges, Fixed fees |

| 13 | 8401 Connecticut Avenue, Suite 401 Chevy Chase, MD, 20815-5833 | $174,914,111 | 642 | 5 | A percentage of AUM, Hourly charges, Other (PERCENTAGE OF RETIREMENT PLAN ASSETS) |

| 14 | 4445 Willard Ave, Ste. 600 Chevy Chase, MD, 20815 | $108,867,841 | 196 | 2 | A percentage of AUM, Hourly charges, Fixed fees |

| 15 | 5425 Wisconsin Avenue, Suite 600 Chevy Chase, MD, 20815 | $0 | 0 | 2 | A percentage of AUM, Performance Based |

Information on Top Retirement Planning firms in Chevy Chase, Maryland

QualificationsFirm CRD# 160668

Assets Under Management $8,453,857,329

No. Of Clients26

Clients Per Financial Advisor0

ARTEMIS REAL ESTATE PARTNERS is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $8B assets under management, the firm specializes in crafting personalized retirement planning solutions for 26 clients. The team consists of 61 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Performance Based

Financial Planning Services

- Portfolio management for pooled investment vehicles

- Portfolio management for businesses or institutional clients

QualificationsFirm CRD# 161468

Assets Under Management $4,084,712,810

No. Of Clients14

Clients Per Financial Advisor0

FCP is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $4B assets under management, the firm specializes in crafting personalized retirement planning solutions for 14 clients. The team consists of 86 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Performance Based

Financial Planning Services

- Portfolio management for pooled investment vehicles

QualificationsFirm CRD# 122478

Assets Under Management $3,951,461,460

No. Of Clients46

Clients Per Financial Advisor3

NEW CENTURY ADVISORS, LLC is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $4B assets under management, the firm specializes in crafting personalized retirement planning solutions for 46 clients. The team consists of 17 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Performance Based

Financial Planning Services

- Portfolio management for individuals and/or small businesses

- Portfolio management for pooled investment vehicles

- Portfolio management for businesses or institutional clients

QualificationsFirm CRD# 157700

Assets Under Management $2,589,069,260

No. Of Clients131

Clients Per Financial Advisor6

ALLIANCE PARTNERS LLC is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $3B assets under management, the firm specializes in crafting personalized retirement planning solutions for 131 clients. The team consists of 23 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Other (ORIGINATION FEES ON PRINCIPAL LOAN TRANSACTIONS)

Financial Planning Services

- Portfolio management for businesses or institutional clients

- Education seminars/workshops

- Other (IDENTIFY AND REFER CREDIT ASSETS TO BANKING INSTITUTIONS.)

QualificationsFirm CRD# 166422

Assets Under Management $1,611,239,387

No. Of Clients17

Clients Per Financial Advisor1

ENLIGHTENMENT CAPITAL is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $2B assets under management, the firm specializes in crafting personalized retirement planning solutions for 17 clients. The team consists of 15 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Performance Based

Financial Planning Services

- Portfolio management for pooled investment vehicles

QualificationsFirm CRD# 328398

Assets Under Management $1,328,788,451

No. Of Clients1654

Clients Per Financial Advisor276

TRITONPOINT WEALTH, LLC is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $1B assets under management, the firm specializes in crafting personalized retirement planning solutions for 1654 clients. The team consists of 6 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Fixed fees

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Portfolio management for businesses or institutional clients

- Selection for other advisors

QualificationsFirm CRD# 104570

Assets Under Management $665,854,051

No. Of Clients476

Clients Per Financial Advisor119

CARDEROCK CAPITAL MANAGEMENT, INC. is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $666M assets under management, the firm specializes in crafting personalized retirement planning solutions for 476 clients. The team consists of 4 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

Financial Planning Services

- Portfolio management for individuals and/or small businesses

- Portfolio management for businesses or institutional clients

QualificationsFirm CRD# 312268

Assets Under Management $496,493,260

No. Of Clients114

Clients Per Financial Advisor114

HZ INVESTMENTS INC. is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $496M assets under management, the firm specializes in crafting personalized retirement planning solutions for 114 clients. The team consists of 1 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

Financial Planning Services

- Portfolio management for individuals and/or small businesses

QualificationsFirm CRD# 168613

Assets Under Management $358,861,756

No. Of Clients3

Clients Per Financial Advisor0

FORT, L.P. is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $359M assets under management, the firm specializes in crafting personalized retirement planning solutions for 3 clients. The team consists of 11 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Performance Based

Financial Planning Services

- Portfolio management for pooled investment vehicles

- Portfolio management for businesses or institutional clients

QualificationsFirm CRD# 315485

Assets Under Management $287,009,717

No. Of Clients3

Clients Per Financial Advisor0

AUGMENT INFRASTRUCTURE MANAGERS ADVISORY LLC is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $287M assets under management, the firm specializes in crafting personalized retirement planning solutions for 3 clients. The team consists of 10 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Performance Based

Financial Planning Services

- Portfolio management for pooled investment vehicles

QualificationsFirm CRD# 104614

Assets Under Management $188,309,554

No. Of Clients314

Clients Per Financial Advisor63

INTERVEST LTD is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $188M assets under management, the firm specializes in crafting personalized retirement planning solutions for 314 clients. The team consists of 5 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

- Fixed fees

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Portfolio management for businesses or institutional clients

- Selection for other advisors

QualificationsFirm CRD# 313338

Assets Under Management $186,500,000

No. Of Clients366

Clients Per Financial Advisor92

BURKHOLDER & ASSOCIATES, LLC is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $187M assets under management, the firm specializes in crafting personalized retirement planning solutions for 366 clients. The team consists of 4 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

- Fixed fees

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Portfolio management for pooled investment vehicles

- Pesnsion consulting services

QualificationsFirm CRD# 127635

Assets Under Management $174,914,111

No. Of Clients642

Clients Per Financial Advisor128

PLOTKIN FINANCIAL ADVISORS, LLC is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $175M assets under management, the firm specializes in crafting personalized retirement planning solutions for 642 clients. The team consists of 5 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

- Other (PERCENTAGE OF RETIREMENT PLAN ASSETS)

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Pesnsion consulting services

- Selection for other advisors

- Education seminars/workshops

- Other (RETIREMENT PLAN CONSULTING)

QualificationsFirm CRD# 333259

Assets Under Management $108,867,841

No. Of Clients196

Clients Per Financial Advisor98

TRITONPOINT PARTNERS, LLC is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $109M assets under management, the firm specializes in crafting personalized retirement planning solutions for 196 clients. The team consists of 2 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

- Fixed fees

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Portfolio management for businesses or institutional clients

- Pesnsion consulting services

- Selection for other advisors

QualificationsFirm CRD# 332085

Assets Under Management $0

No. Of Clients0

Clients Per Financial Advisor0

CARO INVESTORS is a financial advisory firm situated in Chevy Chase, Maryland. With a nearly $0 assets under management, the firm specializes in crafting personalized retirement planning solutions for 0 clients. The team consists of 2 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Performance Based

Financial Planning Services

- Portfolio management for pooled investment vehicles

Retirement Planners Near You

Seeking Retirement Planners in a nearby city? Here are some additional lists of top Retirement Planners in the area:

- Retirement Planners in Annapolis, Maryland

- Retirement Planners in Baltimore, Maryland

- Retirement Planners in Bel Air, Maryland

- Retirement Planners in Bethesda, Maryland

- Retirement Planners in Charlotte Hall, Maryland

- Retirement Planners in Chevy Chase, Maryland

- Retirement Planners in Cockeysville, Maryland

- Retirement Planners in Crownsville, Maryland

- Retirement Planners in Ellicott City, Maryland

- Retirement Planners in Germantown, Maryland

- Retirement Planners in Lutherville Timonium, Maryland

- Retirement Planners in Rockville, Maryland

- Retirement Planners in Silver Spring, Maryland

- Retirement Planners in Towson, Maryland

Looking for more choices? Use our free match service to compare retirement planners serving your area.

Since 1998

Since 1998