8 Things To Consider While Gifting a Home to Your Children

How wonderful would it be if the home where you created all your core memories could stay in the family? The walls that saw birthdays, anniversaries, early morning coffees, and late-night wine conversations could continue to be in your family for generations. A home is a unique financial asset. Unlike stocks, bonds, or mutual funds, a house holds a personal history that no financial asset can replace.

If you are thinking about gifting a house to a child, there are a few things you need to know. There can be tax implications of gifting a house. You also need to know the transfer rules and gauge whether your children actually want to keep or sell the home.

This guide will walk you through 6 important factors to consider before gifting a house to a child.

What should you consider when gifting a house to a child?

1. Understand how capital gains on gifted property are taxed.

When you gift a house to your child, you are essentially transferring ownership without taking any money in return, or at least for less than what the home would sell for on the open market. In tax terms, you are giving away property below its fair market value.

When this happens, the Internal Revenue Service (IRS) does not treat gifts as income. So, when your child receives the house, they will not owe any income tax on it. Likewise, as the parent making the gift, you do not pay any immediate tax either.

However, the tax consequences of gifting a home may arise later, when your child decides to sell it. If they choose to live in it or simply keep it as a family property, no tax applies. But once they sell it, capital gains on gifted property will be taxed. Here’s how it works:

If your child sells the home for less than its fair market value, the IRS could view part of that transaction as a gift rather than a true sale, and taxes could apply accordingly. Thankfully, gift taxes do not hit most people because of the high exemption thresholds. In 2025, you can gift up to $19,000 per recipient and $38,000 for couples without triggering the gift tax.

For amounts above that, you are required to file IRS Form 709 to report the gift and subtract the excess from your lifetime exemption, which stands at $13.99 million for individuals and $27.98 million for married couples in 2025. In most cases, you will not owe any tax unless your total lifetime gifts exceed those limits. After that, the tax rate ranges between 18% and 40%, depending on the value of the gift.

But what about your child when they sell?

The sale may trigger a capital gains tax on gifted property. If they sell the house within a year of receiving it, they will owe short-term capital gains tax, which could range from 10% to 37%. If they hold onto the property for more than a year, it qualifies as a long-term gain, which is taxed at 0%, 15%, or 20%, depending on their income. To report the sale, your child would need to complete Form 8949 and Schedule D when filing their tax return.

2. Consider creating a Qualified Personal Residence Trust (QPRT) if you wish to continue living in the property for some time.

If you are thinking about gifting a house to a child but still plan to live in it for a few more years, you can use a Qualified Personal Residence Trust (QPRT). A QPRT allows you to transfer your home into a trust for a set number of years while continuing to live there during that period. Once the trust term ends, the property passes to the beneficiary at a reduced tax basis.

You can make your child the beneficiary of the trust and transfer the property to them eventually. However, for the QPRT to benefit you and your child, tax-wise, it is imperative that you outlive the trust term. If you pass away before the trust expires, the entire transaction is disregarded, and the property is brought back into your estate for tax purposes.

What does this mean?

It means taxes, just like any other asset in your estate.

However, if you do outlive the term, a QPRT can help lower taxes. The IRS calculates the gift value of the house by subtracting the value of your right to live in the home from the property’s total fair market value. The remaining portion is considered a taxable gift. This sounds a bit technical, so let’s break it down with an example:

Suppose you own a home worth $500,000 and decide to set up a 10-year QPRT. For ease of calculation, let’s assume that the right to live in the house for those 10 years is valued at $200,000, based on IRS actuarial tables and the Applicable Federal Rate (AFR). So, the remainder portion of the home passing to your child after 10 years is worth $300,000. This $300,000 will be treated as a taxable gift. You can still offset it using your lifetime gift tax exemption. If not, your child will be taxed on $300,000 and not $500,000.

3. Read up on how your Medicaid eligibility can be affected if you gift a house to a child.

Medicaid is a government program that helps cover healthcare costs for people with limited income and assets. But if you transfer ownership of your home or any significant asset, for that matter, within five years before applying for Medicaid, you could be affected by a transfer penalty.

Under federal Medicaid law, to be eligible, your total assets and income typically must fall below a set threshold, often around $2,000, depending on the state. If you gift away your home too close to when you might need Medicaid coverage, you could be disqualified for a period.

Now, while the IRS allows you to gift up to $19,000 per year in 2025 without paying gift tax, Medicaid does not recognize that same allowance. Even if your gift falls under that tax-free limit, Medicaid still treats it as a transfer of assets that can delay your eligibility.

There are, however, some exceptions to the rule. Certain transfers are exempt from Medicaid’s transfer penalty, including:

- Transfers to a trust for a disabled child

- Transfers to a child under the age of 21

- Transfers to a child who is blind or disabled

- Transfers to a child who lived with you in the home for at least two years before you moved into long-term care, and who provided care that allowed you to remain at home during that time

Outside of these exemptions, most other home transfers could impact your ability to qualify for Medicaid.

4. Know the tax consequences of gifting a home in case of co-ownership.

Sometimes, you might not want to gift your entire home to your child right away. Instead, you may prefer to co-own the property with them. This can make the eventual transfer smoother. But you must understand both advantages and disadvantages when it comes to taxes and legal exposure.

Let’s start with the upside. One big benefit of co-owning property is convenience. It can simplify matters later on, especially when it comes to estate planning. If your child is already listed as a joint owner on the home title, the property can automatically transfer to them when you pass away with fewer legal formalities.

However, adding your child’s name to the property is also considered a gift in the eyes of the IRS. When you make your child a joint owner, you may be treated as having given them half of the home’s current fair market value. If it exceeds the annual gift exclusion, you will need to report it by filing IRS Form 709. But this amount can usually be covered under your lifetime gift exemption. The tax implications do not stop there. If your child decides to sell the home after your passing, they would be subject to the rules of capital gains on gifted property, and your child could owe capital gains tax on the portion of the property they already owned.

Another thing to note is that once your child becomes a co-owner, the property becomes partly theirs. If your child faces a lawsuit or even divorce, their share of the property could be at risk. Creditors or an ex-spouse might try to claim that portion.

5. Determine the best way to transfer the home.

There are multiple ways to gift a home to your child. This warrants consideration, as the method you choose may significantly affect your tax liability, the timing of the transfer, the level of control retained, and the asset’s future legal protection. Let’s go through some of the common ways you can transfer your home:

- Warranty deed: Herein, full ownership is transferred, with a guarantee of a clear title. Considered ideal for clean, straightforward gifts.

- Quitclaim deed: This type of transfer moves your existing ownership rights to the recipient without providing any legal guarantee regarding the title’s validity. It is common among family transfers; however, it offers limited protection to the recipient.

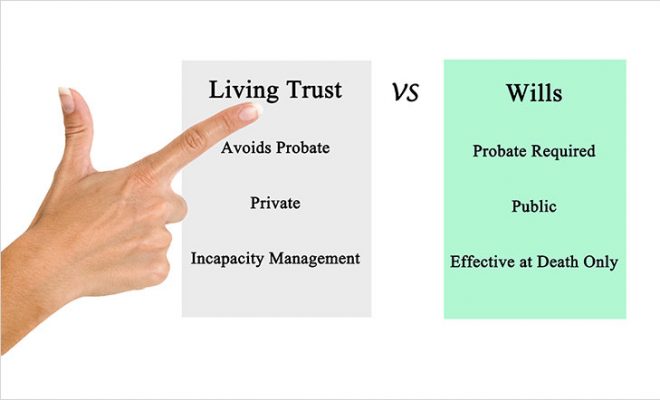

- Transfer-on-Death (TOD) deed: A transfer on death allows you to pass your home to your child automatically upon your death. TODs provide full control during your lifetime, avoid probate, maintain privacy, and are considered cost-effective.

- Adding your child to the title: Directly adding your child to the deed makes them a joint owner. While straightforward, this method may expose your property to creditors, marital claims, or other legal risks.

6. Check for mortgage or lien restrictions.

If your home still has a mortgage, gifting it becomes tricky. Many mortgages include a due-on-sale clause. This allows the lender to demand full repayment in the event of transfer of ownership, including in cases where the transfer is a gift. The lender may or may not enforce this clause; however, one cannot ignore this risk. Apart from this, some additional points should be kept in mind, such as:

- All existing liens on the property (such as unpaid property taxes or contractor claims) must be fully resolved before a clean transfer.

- If there is a mortgage, the child may need to refinance the loan.

- A lender may assess your child’s financial status before approving a transfer.

If the home is paid off, the process becomes a lot simpler. If not, speak with your lender before planning any transfer to ensure you don’t trigger penalties or legal complications.

7. Speak to a financial expert about the best way to gift a house to children.

With so many ways to gift a house to a child, it can be hard to decide which approach is right for you. That is exactly why you should speak to a financial advisor before making any move. The best way to gift a house to children depends on your personal situation, your child’s circumstances, and your long-term financial and health goals.

A financial advisor can help you understand how gifting your property might impact your estate plan and Medicaid eligibility. They can also guide on asset protection. If your child ever faces a lawsuit, jointly owning or gifting the property could expose it to creditor claims. Advisors also play an instrumental role in setting up a QPRT. They can help you understand the specific rules that you need to know clearly before setting it up.

An advisor can also help you evaluate the tax implications of gifting a house, both for you and your child. They can explain how capital gains, gift, and lifetime exemption taxes work.

8. Discuss your plans with your child.

Remember, when you gift a house, the recipient will eventually be responsible for paying tax on the capital gains from the gifted property if they decide to sell it in the future. Some children may not be ready for it and may prefer to inherit the home instead. Gifting a house to a child also involves legal documents, such as title transfers and filings with tax authorities. Not everyone wants to deal with the administrative side, and your child may not feel comfortable handling it.

For many families, one of the best ways to gift a house to children is to leave the home in a will. When the home is passed on as part of your estate, your child inherits it after your death. Estate taxes, if applicable, will be calculated and paid at that time. This approach can reduce the stress and confusion that often come with property transfers during your lifetime.

Speak to your child about what they would prefer.

In short

Gifting a house to a child may feel like the most natural and loving thing to do, and truly, there is no greater gift than a home, both emotionally and financially. However, before you do so, it is important to understand that while generous, there are tax consequences of gifting a home. Potential capital gains tax, gift tax, and more – both you and your child need to be aware of how these rules apply.

To make this process smooth and worry-free, you can use our advisor directory to connect with a financial advisor who can help you and your child through every step of the gifting process.

Frequently Asked Questions (FAQs) about gifting a house to a child

1. What is the best way to gift a house to children?

Direct gifting, using a QPRT, or even granting part ownership can be some great options for gifting a house to a child. The best method depends on your financial situation, your goals, and your child’s preferences.

2. What transfers are exempt from Medicaid’s transfer penalty?

- Transfers to a trust for a disabled child.

- Transfers to a child under the age of 21.

- Transfers to a child who is blind or disabled.

- Transfers to a caretaker child who has lived in the home for at least two years before you moved into long-term care and provided care that allowed you to remain at home during that time.

3. Are there other trust options besides QPRTs?

Yes, there are several alternatives depending on your situation. For example, a Remainder Purchase Marital Trust can be useful if you have a spouse. You can transfer the home to a trust. Your spouse can live in the house for a fixed number of years or for life. The remainder interest is sold to the trust for the children, or it is treated as a gift and counted toward your gift and lifetime tax exemption.

4. Will there be estate and inheritance taxes on a home?

Yes. But these will differ from state to state. Some states have their own gift tax or inheritance tax, which can affect how much your heirs owe when receiving property.