matched to your specific needs

No obligation to hire

Personalized advice for Portfolio

Size of 100K and above

FINRA/SEC Registered Advisors

Find Retirement Advisors for Retirement Planning in Ashburn, Virginia

With so many financial products and solutions available in the market, it is a daunting task to choose the best one for you. We have over 20 years of experience in finding the best financial planner as per your requirements in the field of retirement planning. Our vetted certified retirement financial planners can help you plan for your dream retirement.

All our retirement planners go through rigorous industry experience, disclosures, and registration checks. Our qualified retirement planners are specialized in investment management, insurance advisory, 401k rollovers, and estate planning. Their work experience ranges from being part of small independent firms to Fortune 500 companies.

Finding the Best Retirement Planners in Ashburn, Virginia

Last Updated - February 11, 2026Ashburn has 25 Retirementplanning.net vetted Retirement Planners and Advisors on the online list below for you to choose from and 4 non-vetted advisors in your local area. These retirement advisors in Ashburn, Virginia have an average of 21 years of experience.

HELP ME FIND MY PLANNER

List of Qualified Retirement Planning Advisors in Ashburn, Virginia

VERIFIED

VERIFIEDJoseph Myer

CFP®

Courser Capital Management, LLC

Qualifications

CRD# 4066111

Firm CRD# 6413

Series 7, 66

Minimum Assets Required

$1,000,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Tax Advice and Services, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Flat Fee, Based on Assets

VERIFIED

VERIFIEDQualifications

Firm CRD# 104510

Minimum Assets Required

Not Specified

Address

- 19775 Belmont Executive Plaza,

Suite 530,

Ashburn, VA 20147 See Details - 4000 Legato Road,

8th Floor,

Fairfax, VA 22033 See Details - 1750 Tysons Boulevard,

Suite 1140,

Tysons Corner, VA 22102 See Details - 6550 Rock Spring Drive,

Suite 510,

Bethesda, MD 20817 See Details - 12510 Prosperity Drive,

Suite 350,

Silver Spring, MD 20904 See Details - 1800 Diagonal Road,

Suite 480,

Alexandria, VA 22314 See Details - 6031 University Boulevard,

Suite 150,

Ellicott City, MD 21043 See Details - 900 Bestgate Road,

Suite 407,

Annapolis, MD 21401 See Details - 901 Dulaney Valley Road,

Suite 901,

Towson, MD 21204 See Details

Advisory Services:

Not Specified

Compensation/Fee

Fee-Only, Based on Assets

VERIFIED

VERIFIEDBob Howard

RICP®

Prudential

Qualifications

CRD# 2621872

Firm CRD# 8733

Series 6, 7, 24, 63, 66

Minimum Assets Required

Not Specified

Advisory Services:

Not Specified

Compensation/Fee

Not Specified

VERIFIED

VERIFIEDJeffrey Lippman

CFP®, ChFC®

Capitol Financial Consultants, Inc.

Qualifications

CRD# 5124838

Firm CRD# 109800

Minimum Assets Required

$500,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Investment Advice & Management, Insurance Products & Annuities

Compensation/Fee

Fee-Based

VERIFIED

VERIFIEDCenturion Wealth Management, LLC

CFP®, CPWA®, CIMA®, ChFC®

Qualifications

Firm CRD# 317929

Series 7, 63, 65

Minimum Assets Required

$1,000,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Tax Advice and Services, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Only, Flat Fee, Based on Assets

VERIFIED

VERIFIEDSkip Thompson

Prudential

Qualifications

CRD# 6519243

Firm CRD# 8733

Series 6, 7, 24, 63, 66

Minimum Assets Required

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Legal Advice and Services, Estate Planning & Trusts

Compensation/Fee

Fee-Only, Based on Assets

VERIFIED

VERIFIEDJohn Fitchett

Sym Wealth

Qualifications

CRD# 5314945

Firm CRD# 6413

Series 6, 7, 66

Minimum Assets Required

$250,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Investment Advice & Management

Compensation/Fee

Fee-Based, Based on Assets

VERIFIED

VERIFIEDMY Wealth Management, Inc.

CFP®, ChFC®

Qualifications

CRD# 2818198

Firm CRD# 168566

Series 65

Minimum Assets Required

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Flat Fee, Based on Assets

VERIFIED

VERIFIEDMichael T. Jobe

Glover Park Wealth Management, LLC

Qualifications

CRD# 5179276

Firm CRD# 309793

Series 66

Minimum Assets Required

$25,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Based on Assets

VERIFIED

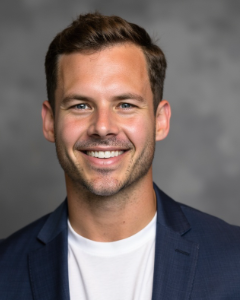

VERIFIEDDrew Leisure

BSG Advisers

Qualifications

CRD# 6295263

Firm CRD# 297243

Series 63, 66

Minimum Assets Required

Not Specified

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Flat Fee, Based on Assets

VERIFIED

VERIFIEDDoug Miller J.D.

CFP®, CLU®

Northwestern Mutual

Qualifications

CRD# 4130719

Firm CRD# 2881

Series 6, 7, 63, 65, 66

Minimum Assets Required

$50,000,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Tax Advice and Services, Estate Planning & Trusts, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Commissions, Flat Fee, Based on Assets

VERIFIED

VERIFIEDTom Hagigh

EPE Wealth Advisors

Qualifications

CRD# 2583423

Firm CRD# 6413

Series 7, 63, 65

Minimum Assets Required

$500,000

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Risk Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Financial Planning for Businesses, Investment Advice & Management, Insurance Products & Annuities

Compensation/Fee

Fee-Based, Commissions, Based on Assets

Advisory Services:

Financial Planning, Portfolio Management, Retirement Planning, 401K Rollovers, Wealth Management, Money Management, Education Funding and Planning, Financial Advice & Consulting, Financial Planning for Individuals, Investment Advice & Management, Tax Advice and Services, Estate Planning & Trusts

Compensation/Fee

Fee-Only, Flat Fee

VERIFIED

VERIFIEDGeoffrey Burroughs

CFP®, Financial Planning Specialist, CDFA®

Harbor Investment Advisory

Qualifications

CRD# 5379858

Firm CRD# 151085

Series 7, 31, 66

Minimum Assets Required

$250,000

Advisory Services:

Not Specified

Compensation/Fee

Fee-Based, Based on Assets

VERIFIED

VERIFIEDChris Schiesser

CFP®

Prudential Advisors

Qualifications

CRD# 5023056

Firm CRD# 8733

Series 6, 7, 63, 65

Minimum Assets Required

Not Specified

Advisory Services:

Not Specified

Compensation/Fee

Not Specified

Top 4 Retirement Planning firms in Ashburn, Virginia (Ranked by AUM)

| Rank | Firm Name | Assets Under Management | Total Clients | Total Advisors | Fee Structure |

|---|---|---|---|---|---|

| 1 | 20405 Exchange Street, Suite 371 Ashburn, VA, 20147 | $322,419,429 | 570 | 4 | A percentage of AUM, Hourly charges |

| 2 | 20755 Williamsport Place, Suite 140 Ashburn, VA, 20147 | $266,491,944 | 476 | 5 | A percentage of AUM, Hourly charges, Fixed fees |

| 3 | 44679 Endicott Drive, Suite 300 Ashburn, VA, 20147 | $151,871,389 | 384 | 3 | A percentage of AUM, Fixed fees |

| 4 | 20135 Lakeview Center Plaza, #110 Ashburn, VA, 20147 | $150,120,693 | 635 | 20 | A percentage of AUM, Hourly charges, Fixed fees |

Information on Top Retirement Planning firms in Ashburn, Virginia

QualificationsFirm CRD# 116670

Assets Under Management $322,419,429

No. Of Clients570

Clients Per Financial Advisor143

HOULIHAN FINANCIAL RESOURCE GROUP, LTD. is a financial advisory firm situated in Ashburn, Virginia. With a nearly $322M assets under management, the firm specializes in crafting personalized retirement planning solutions for 570 clients. The team consists of 4 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

QualificationsFirm CRD# 315692

Assets Under Management $266,491,944

No. Of Clients476

Clients Per Financial Advisor95

THE LEWIS FINANCIAL GROUP is a financial advisory firm situated in Ashburn, Virginia. With a nearly $266M assets under management, the firm specializes in crafting personalized retirement planning solutions for 476 clients. The team consists of 5 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

- Fixed fees

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Portfolio management for businesses or institutional clients

- Pesnsion consulting services

- Selection for other advisors

QualificationsFirm CRD# 315812

Assets Under Management $151,871,389

No. Of Clients384

Clients Per Financial Advisor128

ARBOR PRIVATE WEALTH, LLC is a financial advisory firm situated in Ashburn, Virginia. With a nearly $152M assets under management, the firm specializes in crafting personalized retirement planning solutions for 384 clients. The team consists of 3 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Fixed fees

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Portfolio management for businesses or institutional clients

- Pesnsion consulting services

- Selection for other advisors

QualificationsFirm CRD# 310633

Assets Under Management $150,120,693

No. Of Clients635

Clients Per Financial Advisor32

ABICH FINANCIAL WEALTH MANAGEMENT, LLC is a financial advisory firm situated in Ashburn, Virginia. With a nearly $150M assets under management, the firm specializes in crafting personalized retirement planning solutions for 635 clients. The team consists of 20 skilled financial advisors, committed to delivering comprehensive retirement planning services tailored to your needs.

Fee Structure

- A percentage of AUM

- Hourly charges

- Fixed fees

Financial Planning Services

- Financial planning services

- Portfolio management for individuals and/or small businesses

- Selection for other advisors

- Education seminars/workshops

Retirement Planners Near You

Seeking Retirement Planners in a nearby city? Here are some additional lists of top Retirement Planners in the area:

- Retirement Planners in Alexandria, Virginia

- Retirement Planners in Arlington, Virginia

- Retirement Planners in Ashburn, Virginia

- Retirement Planners in Chesapeake, Virginia

- Retirement Planners in Fairfax, Virginia

- Retirement Planners in Leesburg, Virginia

- Retirement Planners in Manassas, Virginia

- Retirement Planners in Mclean, Virginia

- Retirement Planners in Newport News, Virginia

- Retirement Planners in Richmond, Virginia

- Retirement Planners in Roanoke, Virginia

- Retirement Planners in Vienna, Virginia

- Retirement Planners in Virginia Beach, Virginia

Looking for more choices? Use our free match service to compare retirement planners serving your area.

Since 1998

Since 1998