Estate Planning Tips to Improve Your Succession Planning

End-of-life matters such as wills, trusts, and estates are as important as retirement planning. Estate planning is an effective medium to ensure that your financial assets are used and distributed as per your wishes when you are not around. Estate planning also acts as a reliable asset for times of uncertainties and mishappenings, such as physical or mental disability, inability to handle financial matters, and others. Despite being highly relevant, the prevalence of estate planning has reasonably declined since 2017. As per a survey conducted by Caring.com, only 32% of the survey participants (more than 2400 Americans) said they had the appropriate estate documents, as compared to 42% in 2017. The figures for trusts and advanced health directives were even lower. As alarming as these figures seem, it is crucial to include estate planning as a part of your comprehensive financial plan.

Here are some key estate planning tips to improve your succession planning:

Take inventory of your assets

To ensure that your succession planning is holistic, the first step is to take a well-rounded account of your assets. This can include everything tangible and intangible of value and significance, such as your home and other real estate assets, vehicles, personal possessions, collectibles, stocks and bonds, savings accounts, certificates of deposits (CDs), life and health insurance policies, and retirement plans such as a 401(k) account or an IRA (individual retirement account), etc. Moreover, if you own a business or are a major shareholder in a firm, you will need to consider that too. Once the list is complete, you can estimate the value of these assets. For more accuracy, you could use external valuation metrics such as recent appraisals of your home or real estate and financial account statements. A near-to-accurate estimation of your assets will help you ensure a fair distribution of assets.

Consider your family’s needs

A major goal of estate planning is to secure the future of your loved ones. Hence, the strategy should be structured to ensure that your family is adequately supported in your absence. The most essential component of estate planning is to have suitable life insurance. A life insurance policy offers the required financial support to your family in your absence. It can be used to cover your children’s college fees and marriage expenses. It can also be used to buy a house, pay off debts, or start a business. It is important to buy a cover that can support your family’s standard of living and one that is adjusted as per inflation. Moreover, in the case of minor children or kids with special needs, the estate plan should include the name of a reliable guardian. The guardian can be given the required level of authority needed to ensure the well-being of your children. You can choose a person who you know is a responsible individual and can efficiently work in the interest of your loved ones. Additionally, you can also appoint a property guardian to manage and distribute your estate. Both the guardians can be the same person. But it can help to have separate individuals for each role.

Frame and update your will

While considering succession and estate planning, it is good to have a will in place. Younger people generally do not think about writing a will, but given the vulnerability of life, it is beneficial to have one. The absence of a will can have severe legal complications afterwards. In such circumstances, the law has the sole authority to decide who inherits the estate and in what proportion, thereby undermining your wishes. Moreover, for successful estate distribution, you should review and update your will at each life stage, such as parenthood, retirement, etc. to ensure that your will matches your present plans.

Lay down the directives

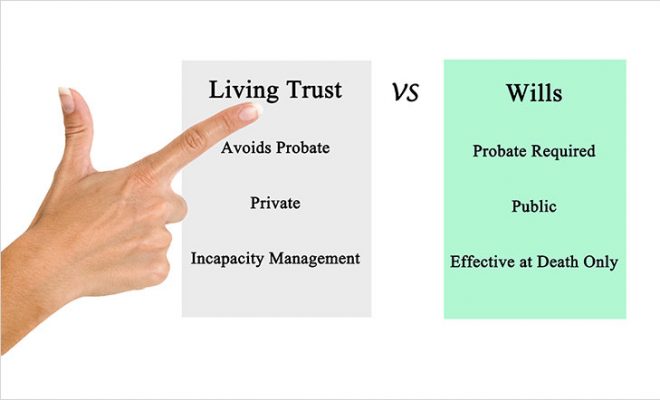

The next critical thing to consider in estate planning is to compile all legal documents and lay down the directives. You can also consider setting up a trust to secure your estate and safeguard the interests of your family. In matters of succession planning, a private trust can function as a convenient option. It is flexible and allows easy management and precise distribution of your assets. It is also an effective way to avoid probate that is usually a result of disagreements between family members and beneficiaries. In addition to this, establishing a private trust enables you to retain significant control while you are alive. The most coveted advantage is that these trusts can be tailored, as per the individual needs of a family. They can also be revoked, modified, or dissolved, as per your wishes. However, it is vital to take due care while appointing trustees and stating terms.

Another crucial step in succession planning is to have an advanced health care directive. This involves creating a living will or appointing a trusted person as your medical representative. This person will be responsible for making all decisions related to your health, in case of your inability to do so. Also, it is important to lay down a power of attorney for holistic succession planning. A power of attorney will allow a person to take charge of the estate in your absence. This will involve dealing with financial matters, assets, and related issues. However, you can add specific clauses, as you deem fit to restrict or increase the power of this individual. But the ultimate choice should be made with utmost prudence and consideration.

Review the beneficiaries

To be certain that your estate is passed on to your successors and in the right share, it is advisable to carefully appoint and review your beneficiaries. Specific assets such as an IRA, a 401 (K) account, a college saving plan as well as annuities, mutual funds, life insurance policies, etc. are directly passed on to the beneficiary (as specified in the particular account), in case of an untimely demise, incapacitation, or disability. Hence, it is vital to name beneficiaries for all such accounts. It is also vital to review them regularly to match them as per your current wishes. You may need to update your nominees in the case of a major life event, such as marriage, divorce, death of a spouse, birth or adoption of a child, etc. Moreover, it also helps to appoint contingent recipients to be sure that the assets are passed on as you see fit. The beneficiary forms are considered the final determinants in deciding who the funds or assets belong to. When compared to a will or a trust, the power of a beneficiary overrules. To understand this better, you can consider taking professional advice on how to direct the benefits of your investments to your loved ones without court intervention.

Minimize taxes

As per the U.S. federal estate tax laws, the estate of a deceased person is subject to specific taxes. For the year 2020, estates with a value of up to $11.58 million are exempted from federal taxation. Moreover, heirs are liable to pay inheritance tax too. Thus, as a part of successful estate planning, you must structure your assets and apply appropriate distribution strategies to minimize the future burden for your beneficiaries. There are many options, such as marital transfers (lifetime gifts or legacy at death to spouse), lifetime gifts to children, conditional transfers to custodians of minors, irrevocable trusts, private annuities, etc., that can help minimize the tax burden for all parties. It is advisable to get professional help in this concern to avoid complications and legal hassles.

To sum it up

Estate planning can seem complicated and sometimes a confusing task to venture into. But if you wish to protect your loved ones, there is no better way than to have an all-rounded estate plan in place. To be sure of your strategy and devise a hassle-free and smooth inheritance process for your beneficiaries, you can seek help from professional Financial Advisors.