Worried about COVID-19? Here’s an Estate Planning Checklist to Ensure Everything is in Order

COVID-19 has caused most of the world to rethink their policies, way of living, and financial strategies. The ‘unforeseen situations’ that most investors and savers prepare for are finally here. At a time when the future holds an immense amount of ambiguity, it becomes imperative to revisit old plans and ensure they are up to date with the current happenings of the world. One such important plan is an estate plan. If you are worried about COVID-19 and how it can affect you and your family’s future, you should consult this checklist to ensure everything is in order.

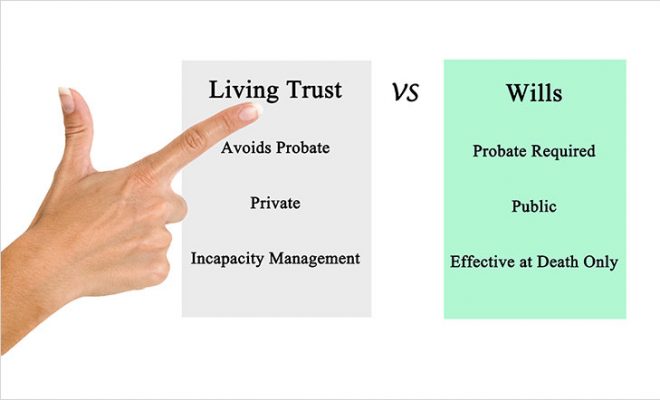

Make sure your last will is updated

Your last will specifies how and when your assets are passed over to your heirs. Make sure that the document contains all the information necessary to ensure a smooth transfer of assets. If you have been recently married or divorced and wish to add or delete some names from your last will, now should be the time to do this. You may also want to add the names of your grandchildren, children, step children, etc. Creating a last will does not mandatorily require a lawyer. Many states also consider handwritten wills under certain circumstances. You can hop on a call with a lawyer or consult an online template to create or update your will.

Living will and advance directives

While a last will indicates how your assets are distributed among your beneficiaries, a living will includes your wishes on life support, medication, etc., in case of your incapacitation. Advance directives such as a power of attorney for health care as well as for handling your finances are incredibly crucial right now. Many COVID-19 patients have been put on ventilators and life support, rendering them incapable of making their own decisions. A living will and medical and financial power of attorney can mandate how your family should proceed in such an unfortunate event. In the absence of a power of attorney, your family member will need to file a petition at the probate court for special powers to make healthcare decisions on your behalf. This can be a time-consuming activity and cost a lot of money.

Check the beneficiaries on all your accounts and policies

The names of beneficiaries should match on your retirement accounts, insurance policies, bank accounts, and your will. If you remarried but forgot to update your spouse’s name on your life insurance account, your current spouse will lose out on the maturity even if your last will contains their name. Revisit all your accounts and make sure the names match to what your last will says.

Have back up trustees

A trust manages your assets on your behalf and helps you specify how and when your money is distributed to your beneficiaries. Trusts are especially helpful in case of minor children as you can put restrictions based on the age when your children can receive their funds. Every trust has a trustee who manages the trust until the beneficiary legally takes over the assets. Given the current state of affairs, if you have a trust or are creating one, you should put some thought into appointing a successor trustee too. If your trustee is incapacitated, the successor can take over the role. When picking out trustees, try to pick people from different age groups and cities, so their chances of falling sick with COVID-19 at the same time are comparatively reduced.

Be prepared for the future

While creating and maintaining these documents is essential, it is also necessary to inform your family members and beneficiaries of their whereabouts. Store your estate planning in a place that is easily accessible to your family members in case of an emergency. You must also rope in your children and get their opinion on how they would like your assets to be distributed given the current climate. Some assets may have temporarily lost their value due to the economic and market downfall. Speak to a professional to understand its implications and reassess your estate plan accordingly.

Take advantage of low rates of interest

The markets are currently down performing so you may want to consider alternative methods of transferring your estate to your beneficiaries that reduce your estate tax overload. One such option is the Grantor Retained Annuity Trust scheme or GRAT. GRAT lets you transfer your estate with little or no estate tax. With a GRAT, your assets are transferred to an irrevocable trust. This trust pays you an annual annuity for a specified number of years. These annuities are either fixed or increase each year, depending on your agreement. After the trust expires, the remaining assets are transferred to your beneficiaries like children, grandchildren, or a spouse. The transfer of funds is taxable, however, the annuities are planned in such a manner that the remaining assets result in very low or sometimes no taxes at all. If the beneficiaries are your grandchildren, you can also benefit from the generation skipping transfer or GST tax.

Do not make decisions out of fear or panic

As troublesome and frightening the future may seem right now, always remember that this will eventually pass. The news reports on fatalities, dropping stock prices, and the red figures on your investment portfolio may seem like the end of the world, but they are not. An estate plan is vital to ensure that your heirs are well provided for in your absence. However, it is necessary to make these decisions with a sound and rational mind and not under any kind of pressure or anxiety.

To sum it up

Coronavirus has uprooted many lives, forcing people to rethink their approach to life. But the one thing that it has taught the world is to be prepared and take preventive measures. The same applies to your estate plan. Revisiting your documents and making sure everything is up to date will bring you and your family some amount of surety in these uncertain times.

If you are creating or re-evaluating your estate plan and need help, you can reach out to Financial Advisor and leverage their professional expertise.